Last Updated on January 23, 2025

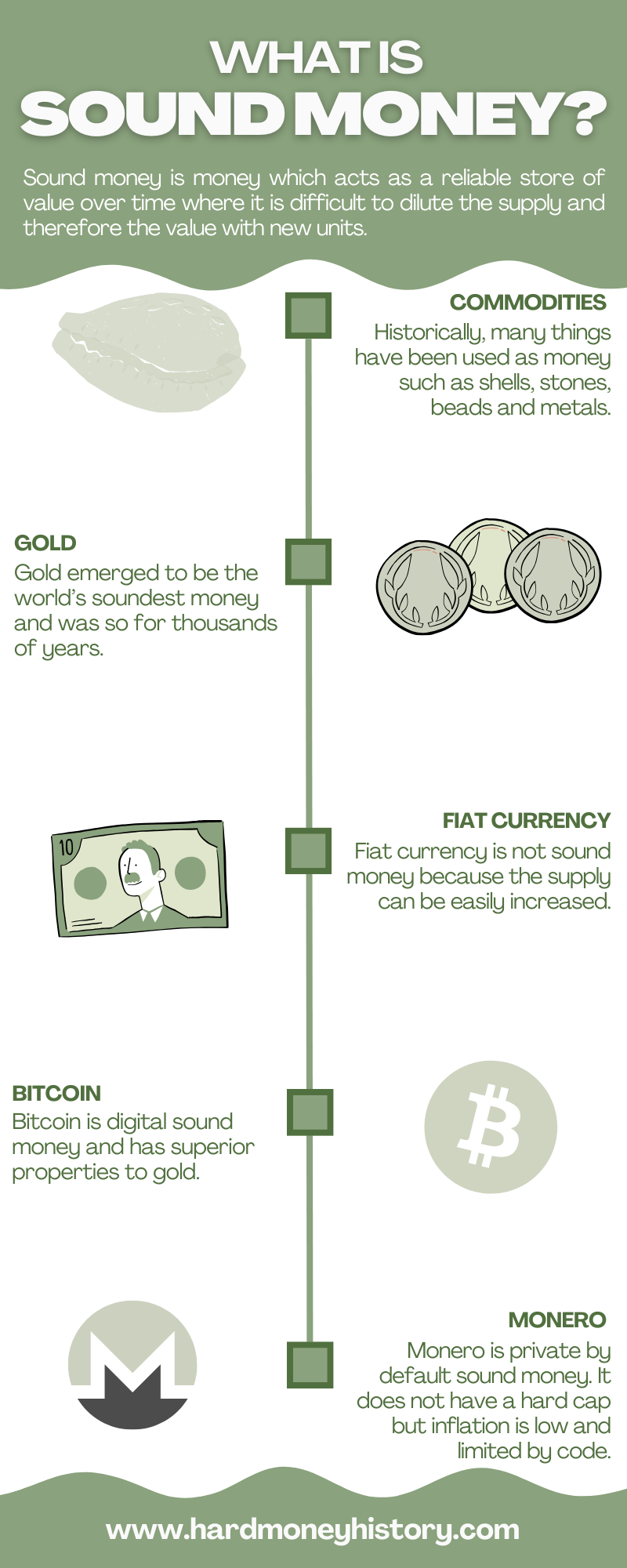

The term “sound money” refers to a type of money which acts as a reliable store of value over time where it is difficult to dilute the supply and therefore the value with new units.

The soundness of money depends on how well it retains its value and how difficult it is to increase the supply of new units relative to the existing stock.

Money that holds its value well with a small rate of increase would be considered sound, whereas money where new units are created quickly and that loses value rapidly would be termed “easy money” in comparison.

Sound money is also often referred to as “hard money.”

Saifedean Ammous in his amazing book, The Bitcoin Standard, has what I consider the best definition of hard money:

“A common characteristic of forms of money throughout history is the presence of some mechanism to restrain the production of new units of the good to maintain the value of the existing units. The relative difficulty of producing new monetary units determines the hardness of money: money whose supply is hard to increase is known as hard money, while easy money is money whose supply is amenable to large increases. We can understand money’s hardness through understanding two distinct quantities related to the supply of a good: (1) the stock, which is its existing supply, consisting of everything that has been produced in the past, minus everything that has been consumed or destroyed; and (2) the flow, which is the extra production that will be made in the next time period. The ratio between the stock and flow is a reliable indicator of a good’s hardness as money, and how well it is suited to playing a monetary role.”

Examples of Sound Money

Historically, many things have been used as money.

These include shells, certain stones, feathers, beads, beans, metals and now Bitcoin and cryptocurrencies.

The most popular and soundest monies were the precious metals, gold and silver.

Is Gold Sound Money?

Gold was the pinnacle of sound money, at least until Bitcoin came along.

While gold has been used as money for thousands of years, it became the standard currency of almost the entire world in the late 19th and early 20th centuries in what was known as the classical gold standard.

Gold’s chemical properties make it ideally suited to function as money. It is scarce, malleable, durable, portable and fungible.

Arguably its key trait is its scarcity. Mining gold is a difficult and intensive process that gets harder and harder each year as the easy to access gold has long been mined. All we are left with is ore that requires significant amounts of capital and labour to extract gold from.

Typically the annual increase in the supply of gold relative to the existing stock is about 1.5% on average.

Is Bitcoin Sound Money?

Bitcoin is a new version of sound money.

There are only 21 million Bitcoin available to be mined and the rate of new supply added to the existing stock is cut in half every four years.

As more miners compete to mine Bitcoin, the mining difficulty is adjusted to ensure that the amount of Bitcoin mined is only what is determined by the code.

Therefore, Bitcoin is a sounder money than gold because it is finite and the new supply arrives on the market on a known and predictable schedule.

Is Monero Sound Money?

Monero is a cryptocurrency where the main value proposition is privacy by default.

However, unlike Bitcoin, Monero has no hard cap.

18.4 million Monero were available to mine as the initial supply. There is also an infinite block reward known as the tail emission of 0.6 XMR per block. This means Monero has an infinite supply.

However, I am a strong advocate of Monero and argue that it is still sound money. Over time the block reward as a percentage of the existence supply will trend towards zero. Eventually the new supply will be almost negligible.

It is still difficult to produce new Monero and new units will be released onto the market on a known and predictable schedule. Monero is a store of value and a medium of exchange and therefore it is sound money.

Is Fiat Sound Money?

The Swiss National Bank Chairman Thomas Jordan defines sound money as money that “fulfils its functions as well as possible.”

Those important functions are a store of value and a medium of exchange.

In theory fiat currency, when managed properly, can fulfil these functions.

However, there are no labour or energy inputs required to create new units of fiat money. The rate at which new units are created depends on decisions made by politicians, central banks, commercial banks as well as the demand for lending.

New units come into existence by typing a few keys on a computer, there is no difficulty at all.

For fiat currency to function as sound money we rely on fallible humans to show restraint. History shows that the temptation to print money is almost impossible to resist. When that happens, fiat currency ceases to be a store of value or a medium of exchange.

Therefore fiat cannot be considered to be sound money.

Why Sound Money Is Important For The Economy

Sound money encourages savings. Savings lead to investment. Investment is necessary for production. Production creates goods and provides incomes. Incomes allow for savings and the virtuous cycle continues.

This is the Austrian view of economics and is how we used to think of money and the economy back when we were on the gold standard.

In an easy money system, the rapid creation of new units of currency devalues the existing stock of money. In this environment, people are encouraged to consume now because they know their money is being devalued over time.

Each dollar buys you less this year than it did last year. To purchase the same item requires more dollars.

This is often viewed as prices rising but it is actually more accurate to view the phenomenon as the value of money falling.

If we consume, we are not saving. If we are not saving we are draining our pool of investable capital. If we do not invest in production, then the growth of production will slow. Eventually production will stagnate and even fall. Then there will be fewer goods and lower incomes and therefore even lower savings.

Less supply, lower incomes and easy devaluing money is a recipe for high inflation.

Saifedean Ammous explains:

“For something to assume a monetary role, it has to be costly to produce, otherwise the temptation to make money on the cheap will destroy the wealth of the savers, and destroy the incentive anyone has to save in this medium.”

On a sound money standard with only a minimal amount of new supply added each year, your money should grow in value from year to year. That means you should be able to buy more for your money next year than you can this year, not less.

Therefore, you are incentivised to delay consumption now and save your money for the future. If you can delay gratification now you will be better off. With an increase in savings there will be more money available for investment, thus higher production, higher incomes and more supply. Coupled with a stable currency that appreciates in value, this is a recipe for rising real wages.

Sound money is important for the health and stability of the economy. Money is one half of every transaction and should be able to function effectively as both a store of value and a unit of account.

If it cannot do these things, then the economy will become more and more inefficient over time.

Why Sound Money Is Important For You Personally

When you live in an economy with sound money you don’t have to think too much.

Just save as much money as possible and you will secure your financial future.

In an easy money system like we have today, saving in fiat money carries the risk that its value will fall year-on-year.

Therefore, it is prudent to consider putting long term savings into something else if you want to preserve your long term purchasing power over time.

For many over the last generation this has been the stock market or the real estate market. But neither stocks nor houses are money.

If you want to save a portion of your assets in hard money, then you have options in gold, silver or bitcoin.

When priced in US Dollars these can appear to be quite volatile assets. On the one hand, this is true for silver, an industrial metal, and Bitcoin, which is wildly volatile because it is so early in its adoption.

However, it is actually more accurate to view the US Dollar as the unstable one, which is in a long term downtrend, while hard money assets gain in value over time.

In the short term this is not always clear but on a long enough time line the trend is very apparent.

Having an understanding of sound money is therefore necessary in order to make informed judgements about how you want to allocate your long term savings.

Saifedean Ammous says it best:

“While people are generally free to use whichever goods they please as their media of exchange, the reality is that over time, the ones who use hard money will benefit most, by losing very little value due to the negligible new supply of their medium of exchange. Those who choose easy money will likely lose value as its supply grows quickly, bringing its market price down. Whether through prospective rational calculation, or the retrospective harsh lessons of reality, the majority of money and wealth will be concentrated with those who choose the hardest.”

Conclusion

Sound money is a term used for money that is an effective store of value and where it is difficult to produce new units.

The production of new units requires an energy input and it is more and more challenging to add to existing stock over time.

Societies have used different forms of money over the years but all sound monies have all shared this characteristic.

By comparison easy money requires no difficulty to add new units to the supply and therefore easy money systems are prone to large supply increases.

Sound money provides a high degree of economic stability. But since we currently live in an easy money system, holding sound money like gold or Bitcoin is a means for you to protect your hard-earned wealth.

Sources

Ammous, Saifedean. The Bitcoin Standard : The Decentralized Alternative to Central Banking Hoboken, New Jersey: John Wiley & Sons, Inc, 2018.

Image Credits

Pile of Silver Coins by Zlataky on Unsplash

Money Changer and a Customer is in the public domain