Last Updated on February 15, 2025

The history of U.S. currency begins with the foreign money of the colonial era and ends with the fiat standard of the post 1971 era.

The Federal Reserve Notes that currently circulate as U.S. currency only became the exclusive legal tender of the United States in 1971.

Before that, the United States had a number of different types of currency that co-existed.

At various times gold and silver have been money, as well as a variety of paper currencies.

Changes in the currency have often occurred as a result of constitutional change, war or economic depression.

Read More: The History of Gold

Read More: The History of Silver

The History of U.S. Currency In The Colonial Era

British, Spanish and Commodity Money

In the colonial era, the money the 13 colonies used was primarily British. In those days Britain was on a silver standard and British silver coins circulated.

However British money was not always readily available, particularly in remote rural areas.

In its place people used commodity money instead. Things like beaver furs, corn, rice, fish and tobacco were common forms of commodity money.

Foreign coins also circulated. The most common was the Spanish Dollar.

Paper Money in the Colonial Era

Massachusetts was the first colony to attempt an experiment with paper money.

They first issued it in 1690 as a way to pay their soldiers. They pledged that the notes would be redeemable in gold and silver and that there would only be one issuance of paper money, so as not to dilute its value.

However, the Massachusetts government did not keep its promises, issuing several further rounds of paper money over the subsequent decades, greatly devaluing the existing notes and causing significant price rises.

Other colonies followed Massachusetts and by the 1750s all the colonial governments were issuing paper currency and causing significant inflation.

This was only brought to an end because the British passed a law prohibiting new issues of paper money and demanding that existing notes be gradually withdrawn from circulation.

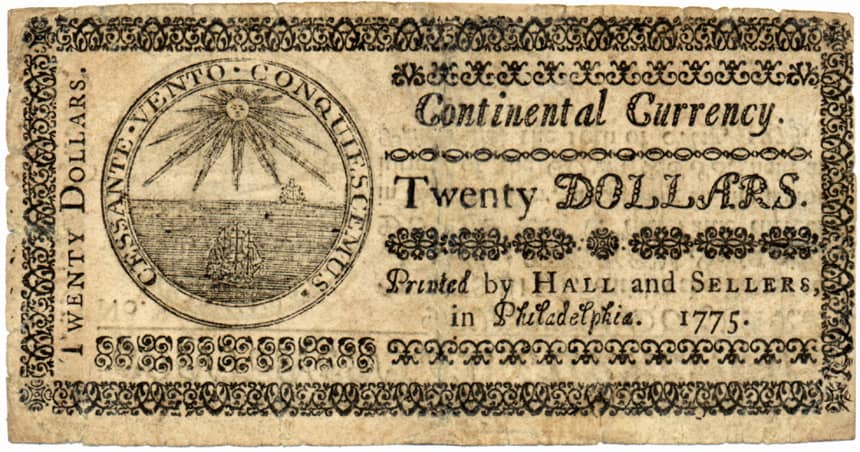

The Continental

Paper money is often used by governments to finance wars because it avoids the difficulties of taxation.

When the Revolutionary War broke out the Continental Congress decided that they would finance the conflict by issuing a paper currency – the Continental.

Continentals were denominated as a specified weight of hard money however, unlike Massachusetts, the Continental Congress did not promise to redeem the notes for physical gold or silver.

Instead they promised that the notes would be removed from circulation in seven years and that future taxation would pay for their redemption.

A staggering amount of paper currency was printed to finance the war and it rapidly lost value against gold and silver. Prices skyrocketed.

In 1775, the money supply was estimated to be $12 million. By 1779 the Congress had issued $225 million.

The Continental Congress’ way out of the situation was to eventually just let the currency depreciate until it was worthless. All notes were withdrawn by the end of the war.

The Bank of North America

In 1782 America’s first attempt at a central bank was established – the Bank of North America.

This was intended to operate in a similar way to the Bank of England. As such, it was a privately owned bank and it was granted a monopoly on the issue of paper money.

This time the money was redeemable for gold and silver. But scarred by the experience of the Continentals, the public did not have much faith in the soundness of the notes of the Bank of North America.

They rapidly lost value and after just one year the bank ceased to operate as a central bank and reverted to being a commercial bank.

The History of U.S. Currency From the Constitution to the Civil War

The 1792 Coinage Act

Four years after the signing of the Constitution, the Coinage Act of 1792 was passed. This gave Congress the power to coin money and therefore centralised control at the federal level.

The Act established the US Dollar as the nation’s monetary standard and defined the dollar as 24.1g of pure silver.

The Act also established the United States Mint in Philadelphia and gave authority for gold, silver and copper coins to be struck.

It also established a bimetallic standard with a silver/gold ratio of 15:1.

State governments were prohibited from either coining money or from issuing paper money.

This was in response to the disaster of the Continental Currency and was designed to instil confidence in the money of the newly independent nation.

While state governments were forbidden from issuing paper money, this did not stop private banks from issuing their own notes.

The First Bank of the United States

Another significant development during the early years of the new nation was the establishment of the First Bank of the United States in 1791 with a 20 year charter.

While not quite fulfilling the same functions as the current Federal Reserve, this was in essence a central bank.

Here is how it worked according to Federal Reserve History:

“The Bank acted as the federal government’s fiscal agent, collecting tax revenues, securing the government’s funds, making loans to the government, transferring government deposits through the bank’s branch network, and paying the government’s bills. The bank also managed the U.S. Treasury’s interest payments to European investors in U.S. government securities… In addition to its activities on behalf of the government, the Bank of the United States also operated as a commercial bank, which meant it accepted deposits from the public and made loans to private citizens and businesses. Its banknotes (paper currency) most commonly entered circulation through the loan process… Banknotes issued by the Bank of the United States were widely accepted throughout the country. And unlike notes issued by state banks, Bank of the United States notes were the only ones accepted as payment of federal taxes.”

Banknotes issued by the Bank of the United States were redeemable for gold and silver. However, by 1811, when the initial 20 year charter expired, the bank had hard money assets of $5.01 million and paper assets of $12.87 million.

This inflation of the paper money supply had generated a significant rise in prices. When the 20 year charter expired it was not renewed.

The Second Bank of United States

The Second Bank of the United States was formed in 1817.

During the war of 1812 there had been a lot of debate about whether a national bank was needed to finance the war effort.

Banks had stopped redeeming their paper for gold and silver during the war and a post war economic downturn convinced the politicians of the need for a new national bank.

It operated in a similar way to the first bank:

“It had much in common with its forerunner, including its functions and structure. It would act as fiscal agent for the federal government — holding its deposits, making its payments, and helping it issue debt to the public — and it would issue and redeem banknotes and keep state banks’ issuance of notes in check. Also like its predecessor, the Bank had a twenty-year charter and operated as a commercial bank that accepted deposits and made loans to the public, both businesses and individuals.”

The Jacksonian Movement

There had always been suspicion in some quarters about central banks going back to Thomas Jefferson.

However the arguments of Alexander Hamilton, who was in favour of central banking, won the day among the founding fathers.

This scepticism was present during the formation of the first and second Banks of the United States and became very prominent in the 1820s as the Jacksonian Movement.

The second Bank of the United States had created an inflationary boom in 1817 and 1818, with the money supply ballooning by over 40%. This resulted in a depression in 1819.

Out of this chaos a movement emerged advocating a commitment to hard money and 100% reserve banking.

Jackson became President in 1829.

He vetoed the re-charter of the Second Bank of the United States in 1832.

“A bank of the United States is in many respects convenient for the Government and useful to the people. Entertaining this opinion, and deeply impressed with the belief that some of the powers and privileges possessed by the existing bank are unauthorized by the Constitution, subversive of the rights of the States, and dangerous to the liberties of the people, I felt it my duty at an early period of my Administration to call the attention of Congress to the practicability of organizing an institution combining all its advantages and obviating these objections. I sincerely regret that in the act before me I can perceive none of those modifications of the bank charter which are necessary, in my opinion, to make it compatible with justice, with sound policy, or with the Constitution of our country.”

– Andrew Jackson

Jackson also removed government funds from the bank which had the effective of essentially destroying it as an institution. The bank then expired when the charter expired in 1836.

In 1836 Jackson issued an executive order called the specie circular which ordered that all public lands had to be purchased with hard money.

The separation of government and banking which began with President Jackson continued under President van Buren. The era between 1836 and 1862 was known as the era of free banking. There was no national bank and notes were issued by state chartered banks.

The soundness of these notes was determined by the gold and silver reserves of the banks and the degree of confidence that the public had in them.

The History of U.S. Currency During The Civil War

The civil war led to a return to federal issues of paper money in order to finance the conflict.

The first issue in 1861-1862 were called “Demand Notes” because they were redeemable into gold and silver on demand.

Very soon these Demand Notes were replaced with “United States Notes” which were issued between 1862-1865. Both Demand Notes and United States Notes were known as Greenbacks.

The 1862 Legal Tender Act established that United States Notes were not redeemable for gold and silver, which effectively ended the bimetallic standard and put the country on a paper standard.

While the federal government had initially hoped for just one emergency issue of United States Notes, they issued more and more notes over time, causing their value to fall against gold and silver.

Over the course of the Civil War, the total money supply expanded 137.9%.

The Civil War also gave rise to the National Banking System which was a forerunner of the Federal Reserve System, reversing the changes made by Presidents Jackson and van Buren.

Murray Rothbard argues that this was highly inflationary:

“Before the Civil War, every bank had to keep its own specie reserves, and any pyramiding of notes and deposits on top of that was severely limited by calls for redemption in specie by other, competing banks as well as by the general public. But now, reserve city banks could keep half of their reserves as deposits in New York City banks, and country banks could keep most of theirs in one or the other, so that as a result, all the national banks in the country could pyramid in two layers on top of the relatively small base of reserves in the New York banks. And furthermore, those reserves could consist of inflated greenbacks as well as specie.”

Confederate Currency

The Confederacy also issued large quantities of paper currency. The Confederate Dollar was issued in 1861 and was legal tender in those states that formed the Confederacy.

It was not backed by any hard asset but carried a promise that the bearer would be compensated at the conclusion of the war.

As it became apparent that the Confederates would not win the war and thus the bearer would not be compensated its value diminished. More paper was issued reducing its value even further.

By the end of the war the Confederate Dollar was worthless.

The History of U.S. Currency During The Gold Standard Era

The Coinage Act of 1873

Shortly after the Civil War the United States joined Britain and Germany by adopting the gold standard.

The 1792 Coinage Act had put the United States on a bimetallic standard, while the Civil War had put the country on a paper standard.

The Coinage Act of 1873 ended bimetallism by removing the right of holders of silver bullion to have their silver freely minted into the standard silver dollar coins (known as free coinage of silver).

The 1873 Act didn’t formally place the US on the gold standard but by ending the free coinage of silver it had that de facto effect.

By 1879 parity between gold dollars and greenbacks was achieved, ending the paper standard and returning the United States to a gold standard.

However, paper money still circulated as a redeemable substitute for gold.

Craig Elwell explains:

“The government stood ready to pay its debts in gold, accept greenbacks for customs, and to redeem greenbacks on demand for gold. Greenbacks were perfect substitutes for gold coins. The government had returned to a gold standard; but two important changes had taken place with respect to paper money: (1) the government now was an issuer of paper money redeemable on demand and (2) the paper money was legal tender. “

The gold standard would later became formalised in legislation with the 1900 Gold Standard Act.

1878 Silver Certificates

The 1873 legislation became known as the crime of 1873. Silver miners and those holding silver were heavily affected as the value of silver declined against gold. The working classes who needed coins to circulate in smaller values were also worse off.

Amid the criticism of the crime of 1873, the Bland-Allison Act of 1878 was passed. While this did not restore the free coinage of silver, it did restore silver to legal tender status and required the Treasury to purchase between $2 million and $4 million of silver per month to be minted into coins.

As a result, the government issued silver certificates which were redeemable on demand for silver coin.

The silver lobby also managed to get the Sherman Silver Purchase Act signed into law in 1890 which compelled the US Treasury to purchase 4.5 million ounces of silver per month. However this was soon repealed in 1893 after in created a financial panic.

Silver certificates remained in circulation until 1964.

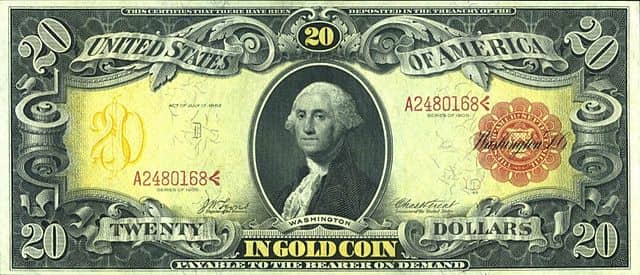

Gold Certificates

Gold certificates were printed from 1865, but since United States Notes at that time were legal tender, the gold certificates did not widely circulate.

From 1879 the United States was on a gold standard. With United States notes able to be redeemed in gold, this put gold certificates and Greenbacks on a par, allowing gold certificates to be used in general circulation.

Gold was priced at $20.67 per ounce. Or more accurately, $20.67 of paper currency could be redeemed for 1 ounce of gold.

Just like Greenbacks, gold certificates were able to be redeemed on demand for the equivalent amount of gold coin.

The Gold Standard Act of 1900 formalised what had been quite a chaotic monetary arrangement. Greenbacks, silver certificates and silver dollars were all able to continue as legal tender, however gold became the monetary standard.

1913 Federal Reserve Act

After a financial panic in 1907, there was a move towards a central bank styled on the European central banks. The Federal Reserve Act of 1913 established this system, which then came into existence in 1914.

The Federal Reserve introduced a new form of paper currency called the Federal Reserve Note.

However, at its inception the United States was still on the gold standard. Therefore gold was still money and Federal Reserve Notes were redeemable for gold. $20.67 worth of paper currency could be redeemed for 1 ounce of gold.

At the time of their inception, Federal Reserve Notes circulated among the existing United States Notes and gold and silver certificates.

The History of U.S. Currency From FDR to Nixon

The End of the Gold Standard

The European powers had come off the gold standard at the start of World War One, while the US had maintained it. The Europeans then returned to a quasi gold standard from 1925 before subsequently abandoning gold again in 1931.

In 1933 President Roosevelt followed this trend and brought the gold standard to an end in the United States.

The ending of the gold standard had three components. United States citizens were prohibited from owning gold, a embargo was placed on the export of gold and the dollar was devalued by adjusting the price of gold from $20.67 to $35 per ounce.

Again, more accurately this should be described as more paper currency being required to purchase the same ounce of gold.

The US Dollar was still tied to gold. But since US citizens could not convert their paper currency into gold it was not a true gold standard.

The Silver Purchase Act

FDR’s other significant monetary legislation was the Silver Purchase Act of 1934.

A remnant of the late 19th century silver movement still existed and was able to wield significant influence in the United States legislature. They put pressure on FDR to remonetise silver.

While he did not restore silver to full monetary status he did begin a federal purchase programme designed to support Western mining interests.

William Silber describes how it worked:

“[It] permitt[ed], but [did] not require, the president to purchase silver bullion until it comprised one-fourth of the combined value of gold and silver reserves for America’s money and to issue paper dollars called silver certificates redeemable in the white metal. In addition, the bill authorized the president to nationalize at his discretion all the silver bullion in the United States as had been done with gold. Henry Morgenthau, who had become Treasury secretary in January 1934 and would implement the purchase program, said that he would buy surplus stocks of silver and treat the “permissive provisions” as though they were mandatory.”

Silver acquired by the Silver Purchase Act was stored in a vault at West Point and the government issued silver certificates which circulated as currency.

William Silber explains:

“The Treasury paid for bullion under the Silver Purchase Act either by creating silver dollar coins containing about three-quarters of an ounce of silver or by issuing silver certificates in one-dollar, five-dollar, and ten-dollar denominations. The Treasury’s certificates closely resembled Federal Reserve notes issued by America’s central bank, the dominant form of money in the United States, except the label “Silver Certificate” instead of “Federal Reserve Note” appeared at the top. The different types of money were equally accepted everywhere, such as paying for groceries at the local supermarket or settling obligations with the IRS, and were used interchangeably.”

Bretton Woods

A massive shift in the international monetary system occurred towards the end of World War Two at the Bretton Woods conference.

The United States was poised to emerge from the war as the world’s sole economic superpower, while the formerly strong European powers were financially devastated.

This resulted in the US Dollar replacing the British Pound as the global reserve currency. It was agreed that foreign currencies were to be set at fixed exchange rates in relation to the US Dollar.

Since the US Dollar was still linked to gold at $35 per ounce, this effectively meant that the world was still on a quasi gold standard.

While US citizens could not redeem their paper currency for gold, foreign governments were free to exchange their US Dollars for gold at $35 per ounce.

The Final Demonetisation of Silver

FDR’s Silver Purchase Act had set a fixed price that the government would pay to acquire silver. It was also required to sell silver at that same price.

The government price was normally above the market price. Therefore silver producers were happy to sell to the government at that high price while nobody would buy from the government at that price since they got a better deal in the free market.

However, when the market price broke above the government price it became profitable to buy government silver at a discount to the market. This began a run on the government’s silver stock.

Instead of raising the government price as they had done in the past, in 1961 President Kennedy decided instead to suspend government sales of silver. He then began the process of demonetising it.

In 1963 the Silver Purchase Act was repealed and the 1965 Coinage Act saw the the removal of silver from the dime and the quarter and a reduction of silver from 90% to 40% in the half dollar.

From 1968, the silver certificates were no longer redeemable in silver bullion. While they remained legal currency they could only be exchanged for Federal Reserve Notes rather than for silver itself. When the silver certificates ended up in the Treasury they were exchanged for Federal Reserve Notes and removed from circulation.

Closing The Gold Window

The United States took advantage of their privileged position as a result of Bretton Woods by pursuing an inflationary policy and expanding the supply of Federal Reserve Notes in circulation.

This was a cause for concern for European powers who were holding US Dollar reserves that were declining in value.

To resolve this problem France, in 1965, decided to exercise their option to redeem their US Dollars for gold at $35 per ounce. This was a good deal for them as the United States money printing meant the market price for gold (had there been one) would have been much higher. This was a bad deal for the United States because it meant gold was flowing out while devalued paper currency was flowing in.

Instead of responding to the situation with a tighter monetary policy to restore confidence in the dollar, the United States decided to instead end what remained of the quasi gold standard.

Embroiled in the Vietnam War and pursuing the Great Society, reducing government spending and tighter monetary policy was not something that the government wished to pursue.

So in 1968 President Johnson put an end to the requirement for 25% of the money supply to be held as gold reserves.

President Nixon then took his famous action in 1971 known as “closing the gold window” by bringing an end to the convertibility of dollars into gold by foreign governments.

This had the effect of severing the last formal tie between the dollar and gold and putting the whole world onto a fiat money standard.

Nixon also devalued the dollar by repricing gold from $35 per ounce to $38 and then again to $42.22 by 1973.

$42.22 is the still the price at which the US government prices the gold on their books despite the fact that gold now trades freely at much higher market prices.

The History of U.S. Currency In The Fiat Era

United States Notes, which had continued to circulate alongside Federal Reserve Notes, were also removed from circulation in 1971.

This meant that by 1971 United States Notes, silver certificates and gold certificates were all no longer in use and Federal Reserve Notes became the sole form of U.S. currency.

The ability for private citizens to hold gold was restored in 1972 and gold now trades freely at market prices.

While gold is no longer an official form of money in the United States, it is significant that the Federal Reserve still holds 8000 tonnes of gold as reserves.

Jim Rickards calls this the shadow gold standard, where the U.S. Dollar is still in effect backed by the nation’s gold reserves. Despite not being able to redeem dollars for the metal, the existence of the 8000 tonnes of gold gives a degree of confidence to the soundness of the US Dollar.

Since 1971 the US government has continued an inflationary money printing policy. This has seen the market price of gold go up dramatically. Or more accurately, it has seen the value of US Dollars fall in relation to gold.

Conclusion

The United States has gone through several different monetary eras with several different monetary experiments.

In the colonial era they used commodity money, foreign coinage and even experimented with paper money.

As a new nation the United States adopted a bimetallic standard. Over the subsequent centuries she witnessed an ongoing debate about the role of central banking and another ongoing debate about the relative merits of a gold standard vs a bimetallic one.

When the current Federal Reserve system came into being the United States was on a gold standard and paper currency was freely redeemable for gold.

This was gradually ended over several decades between 1934 and 1971 and the country is now on a fiat money standard with Federal Reserve Notes as the sole circulating currency.

So far the public has been reasonably accepting of this system but since the 2008 financial crisis cracks have been beginning to show.

The lesson that can be learned from the history of U.S. currency is that the monetary system is constantly evolving and constantly changing in response to the circumstances of the day.

While the government tinkers, what has remained remarkably constant is gold. Whether the country has been on a bimetallic standard, a gold standard or a fiat standard, gold has maintained its value and protected individuals from government folly.

This was just as true in the War of Independence, the Civil War, the 20th Century as it is in the present day.

Sources

Rickards, James. 2019. The New Case for Gold. London: Penguin Business.

Rothbard, Murray N. A History of Money and Banking in the United States : The Colonial Era to World War II. Auburn, Ala.: Ludwig Von Mises Institute, 2005.

Silber, William L.. The Story of Silver : How the White Metal Shaped America and the Modern World. Princeton, New Jersey: Princeton University Press, 2021.

Image Credits

US Dollars by Alexander Schimmeck on Unsplash

Continental is in the public domain

1792 Quarter Dollar is in the public domain

Demand Note is in the public domain

United States Note is in the public domain

Confederate Note is in the public domain

1878 Silver Certificate is in the public domain

1905 Gold Certificate is in the public domain

1914 Federal Reserve Note is in the public domain

1934 Silver Certificate is in the public domain

2009 Federal Reserve Note is in the public domain