Disclaimer

This article is for informational and educational purposes only and does not constitute financial advice. The author may hold positions in the assets discussed. Any discussion on jurisdiction, exchanges or custody providers reflect the author's personal views and experiences and is not a personal recommendation. Always do your own research and seek professional guidance before making investment or custody decisions.

Last Updated on September 23, 2025

The best gold coins to buy for an investment are the ones that you can easily resell.

That means avoiding more obscure products and sticking with highly liquid coins issued by national mints.

In no particular order, these are the best investment coins:

- Canadian Maple Leaf

- Austrian Philharmonic

- Australian Nugget

- Chinese Panda

- British Britannia

- American Buffalo

- American Eagle

- South African Krugerrand

While there are a few subtle reasons that might make one of these coins more of a preference than another, generally speaking all of these are sound and safe options as investable gold coins.

Are you investing in gold for the first time? Then I’d recommend checking out this article: How To Invest In Gold For Beginners.

Why These Gold Coins Are The Best To Buy

1. Liquidity

The most important reason to stick to one of these popular gold coins is that they are widely recognised and trusted worldwide. That means there is a highly liquid and strong secondary market.

If you invest in lesser known coins you may find it harder to find a buyer which may affect resale price.

2. National Mint Standardisation and Authenticity

There is nothing wrong with buying gold products from highly regarded private mints. But for many investors there is a certain reassurance that comes with purchasing from a national mint. Since you are likely to be reselling to those cautious investors then it makes sense to buy from a national mint where the weight and purity of the coin are guaranteed.

All of the gold coins listed above have either 99.99% or 91.67% gold purity. This is also known as 24 karat or 22 karat gold.

The American Eagle, South African Krugerrand and British Britannia coins pre 2013 are all 91.67% fine, the remainder are 99.99%.

All the coins come in a 1oz denomination, with many offering fractional weights as well.

The exact percentage of gold content doesn’t matter, the point is that it is standardised and you can trust that every coin of that mint will have the same weight and purity.

3. Low Premiums Over Spot

The spot price is the market price of gold per ounce you will see quoted. However it is very rare to buy gold at the spot price. Typically you will have to pay a premium over spot which is the margin for the reseller.

Rare, collectible or numismatic coins tend to have much higher premiums. Bullion coins by national mints carry low premiums meaning the price is much more reflective of the intrinsic gold content.

4. Strong Historical Track Record

Krugerrands have been produced since 1967 and Maple Leafs since 1979.

All of these national mint coins have a strong track record in the fiat era. Mints don’t produce coins for exchange anymore, they produce them for investable bullion value.

And investors have shown over time that they value this product. A newer or less established product without the same track record might not have the same appeal when the time comes to sell.

5. Tax Efficiency

In some jurisdictions there are certain tax advantages when buying coins from the national mint.

For example in Britain there is no capital gains tax on any coins produced by the Royal Mint. So it wouldn’t make sense to buy from anywhere else.

When To Consider Alternatives

If you are buying in bulk and can afford to buy bars, then it is more efficient to do so as they often have lower premiums.

If you are a collector and you know what you are doing when it comes to numismatic coins, then go for it.

If there are tax efficiencies in your jurisdiction for buying a particular coin that is not one of the big global players, then that also makes sense.

But for the rest of us, sticking to the globally recognised coins is the safest option.

My Choice: The Canadian Maple

When I first bought gold and silver I went to my local New Zealand Mint and came away with gold kiwi and silver taku. I didn’t think too much of it at the time and I have easily resold to the New Zealand Mint with no problems.

But all my subsequent purchases have been Canadian Maples.

I wanted a 99.99% coin and, since I wasn’t in the USA, I didn’t feel the need for an American coin. I chose the Canadian Maple because it was a popular international choice and I could easily access it through my dealer, BullionStar.

Best Gold Coins To Buy For Investment

Canadian Maple Leaf

First Produced: 1979

Mint: Royal Canadian Mint

Purity: 99.99%

The South African Krugerrand was the first globally popular investable bullion coin and the Canadian Maple was the second.

However, with the Krugerrand being 91.67% pure, the Maple pioneered 99.99% purity. This made it a popular option amongst global investors and set the standard for other coins to follow.

Austrian Philharmonic

First Produced: 1989

Mint: Austrian Mint

Purity: 99.99%

This coin is widely regarded as one of the most beautiful of the modern era, featuring instruments of the famous Vienna Philharmonic on both sides.

This is a very popular coin for European investors.

Australian Nugget

First Produced: 1986

Mint: Perth Mint

Purity: 99.99%

Australia is one of the world’s top producing gold nations and the Perth Mint is a famous and reputable institution. The Australian Nugget was briefly the world’s top selling coin in the early 1990s.

The point of difference with this coin is that it goes into denomination larger than 1oz, offering 2oz and 1kg gold coins.

Chinese Panda

First Produced: 1982

Mint: Chinese Mint

Purity: 99.99%

This is a very popular coin amongst Chinese and other Asian investors. It is renowned for its beautiful designs that change every year.

This coin has also been very significant for the economy of China, helping to grow the precious metals industry and establish China as a major global player in the gold market.

British Britannia

First Produced: 1987

Mint: The Royal Mint

Purity: 91.67% before 2013 and 99.99% 2013 and after

Britain has long been a powerhouse in the gold market and the global economy and has a long history of producing gold coinage.

The Britannia is Britain’s modern answer to the growing demand by investors for gold bullion coins and was designed to compete amongst the likes of the American Gold Eagle and the Canadian Gold Maple.

American Buffalo

First Produced: 2006

Mint: United States Mint

Purity: 99.99%

The American Buffalo is a relative latecomer to the club of 99.99% purity. Initially the US Mint only produced the 91.67% pure American Eagle, however demand for 99.99% pure gold coins led to the creation of the Buffalo.

This coin is popular in the United States, although still is less popular than the American Eagle.

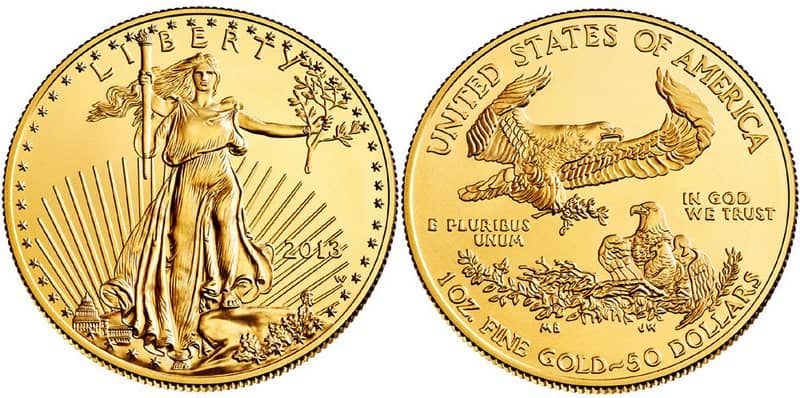

American Eagle

First Produced: 1986

Mint: United States Mint

Purity: 91.67%

The American Gold Eagle is an iconic bullion coin. Naturally, it is most popular in its home country, while international investors may prefer other options.

The main limitation on buying gold Eagles is that it is only 91.67% pure. But if you are planning on reselling to American investors then there is little problem.

South African Krugerrand

First Produced: 1967

Mint: South African Mint

Purity: 91.67%

This coin is world famous as the first investible bullion coin of the modern era.

Initially there were no alternatives and the Krugerrand dominated the market, popularising gold investment by individuals in accessible denominations.

This coin was the inspiration for all the others that followed and, now that there are so many competitors, it no longer commands the prestige it once did. Nevertheless is it still a valid option for a gold coin investment.

Conclusion

The best gold coins to buy for an investment are popular liquid options where you will have no problem with resale.

These are produced by national mints and have a global reputation and strong historical track record.

While there are many to choose from, my personal favourite is the Canadian Gold Maple.

Image Credits

Gold Eagle is licensed under CC-BY-SA 3.0